About Risk Management Explained

Learn about the fundamental concepts of risk management, including its distinction from crisis management. Uncover various risk factors such as strategic risks, compliance risks, operational risks, financial risks, and reputational risks.

Dive into risk assessment techniques, encompassing impact vs probability, risk tolerance, and risk identification methods such as SWOT analysis. Master the art of qualitative and quantitative risk analysis with tools like Risk Probability-Impact Matrix and Monte Carlo Simulation.

Explore effective risk mitigation strategies, and acquaint yourself with global risk management frameworks like ISO 31000 and COSO ERM. Additionally, delve into industry-specific risk management practices in finance, IT, and supply chain, and learn about the cutting-edge AI-driven risk management solutions.

‘...frontrunner in delivering top-tier digital business resources...’

‘...has been making waves with its flagship product...’

‘...consistent emphasis on simplifying complex business topics...’

‘...shaping the future of digital business learning...’

‘...valuable resource in the ever-evolving world of business education...’

Table of contents

- Introduction to Risk Management

- Risk Management vs Crisis Management

- Risk Factors and Triggers

- Strategic Risks

- Market Competition

- Changing Consumer Preferences

- Technological Innovations

- Mergers and Acquisitions

- Compliance Risks

- Regulatory Changes

- Data Protection and Privacy Laws

- Environmental Regulations

- Industry-Specific Regulations

- Operational Risks

- Supply Chain Disruptions

- Information Technology Failures

- Process Failures

- Human Errors

- Financial Risks

- Market Risks: Interest Rate Risk, Foreign Exchange Risk, Commodity Price Risk

- Credit Risks: Counterparty Default, Concentration Risk

- Liquidity Risks

- Operational Risks: Fraud, Processing Errors

- Reputational Risks

- Social Media and Online Reputation

- Media Coverage

- Stakeholder Relationships

- Risk Assessment

- Risk Evaluation: Impact vs Probability

- Risk Tolerance and Appetite

- Risk Identification Techniques: Brainstorming, SWOT Analysis, Scenario Analysis

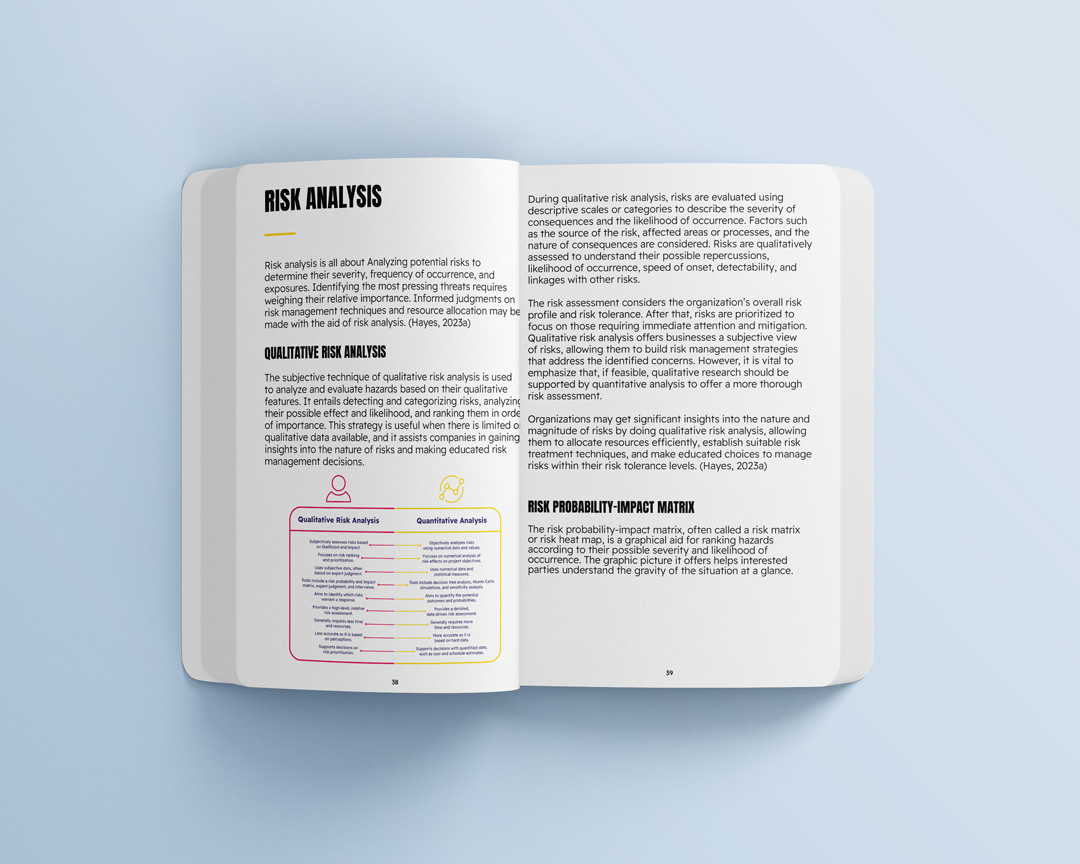

- Risk Analysis

- Qualitative Risk Analysis

- Risk Probability-Impact Matrix

- Expert Judgment

- Risk Data Quality Assessment

- Quantitative Risk Analysis

- Sensitivity Analysis

- Expected Monetary Value (EMV) Analysis

- Monte Carlo Simulation

- Discrete-Event Simulation

- Risk Mitigation

- Risk Avoidance

- Risk Reduction

- Risk Sharing

- Risk Acceptance

- Risk Monitoring and Reporting

- Risk Management Frameworks

- ISO 310

- COSO ERM Framework

- The Basel Accords

- NIST Risk Management Framework

- Risk Management in Different Industries

- Financial Risk Management

- Hedging

- Diversification

- Credit Risk Analysis

- Stress Testing

- IT Risk Management

- IT Risk Assessment

- Implementation of Security Measures

- Regular IT Audits

- Incident Response Planning

- Project Risk Management

- Project Risk Assessment

- Risk Response Planning

- Contingency Planning

- Regular Project Reviews

- Supply Chain Risk Management

- Supply Chain Visibility

- Supplier Risk Assessment

- Diversification of Supply Sources

- Contingency Planning and Business Continuity Planning

- AI-driven Risk Management Solutions

- Predictive Analytics

- Natural Language Processing for Risk Analysis

- Machine Learning for Pattern Recognition

- Automated Risk Response

- Machine Learning for Optimizing Risk Mitigation Strategies

- AI in Compliance and Regulatory Risk Management

55 Products Included

All Products Special

Order our bestselling business bundle now and save a whopping $3,544 compared to buying each product separately.

Risk-free Purchase: Full refund within 14 days

Safe and Secure Checkout

This is a limited-time offer!

Testimonials

97%

Exeptional feedback from our readers

Risk-free Purchase: Full refund within 14 days

Risk-free Purchase: Full refund within 14 days

Safe and Secure Checkout

Safe and Secure Checkout