About Financial Crisis Explained

The Financial Crisis Guide is a new book containing a collection of articles and research papers that are relevant to financial crises. In some form, it covers the causes and institutional dynamics of the financial crisis to macroeconomic developments and the behavior of interest and inflation rates.

Today, there are many interesting books available on this subject, but they were all created prior to the last financial collapse.

This book will help you educate yourself about the causes and consequences of the financial crisis in a clear, intuitive, and accessible way.

‘...frontrunner in delivering top-tier digital business resources...’

‘...has been making waves with its flagship product...’

‘...consistent emphasis on simplifying complex business topics...’

‘...shaping the future of digital business learning...’

‘...valuable resource in the ever-evolving world of business education...’

Table of contents

- Introduction

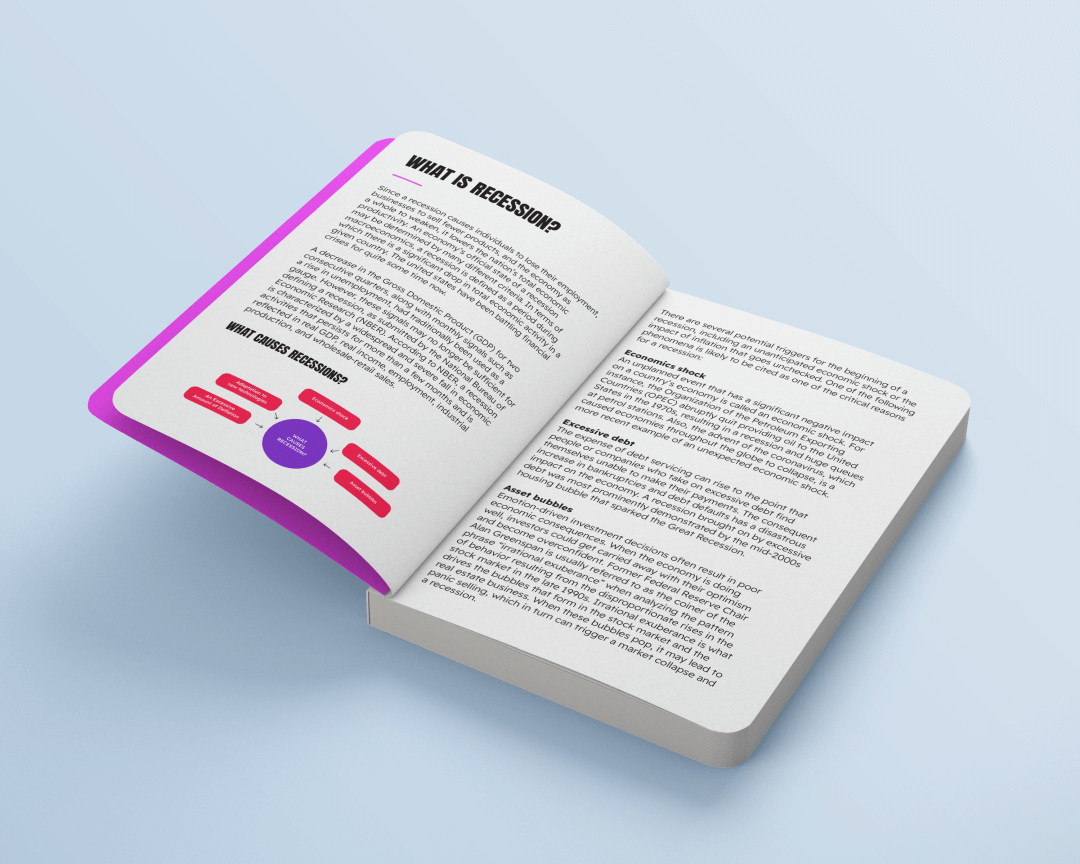

- What is recession?

- What causes recessions?

- Recessions and the business cycle

- How does a recession affect me?

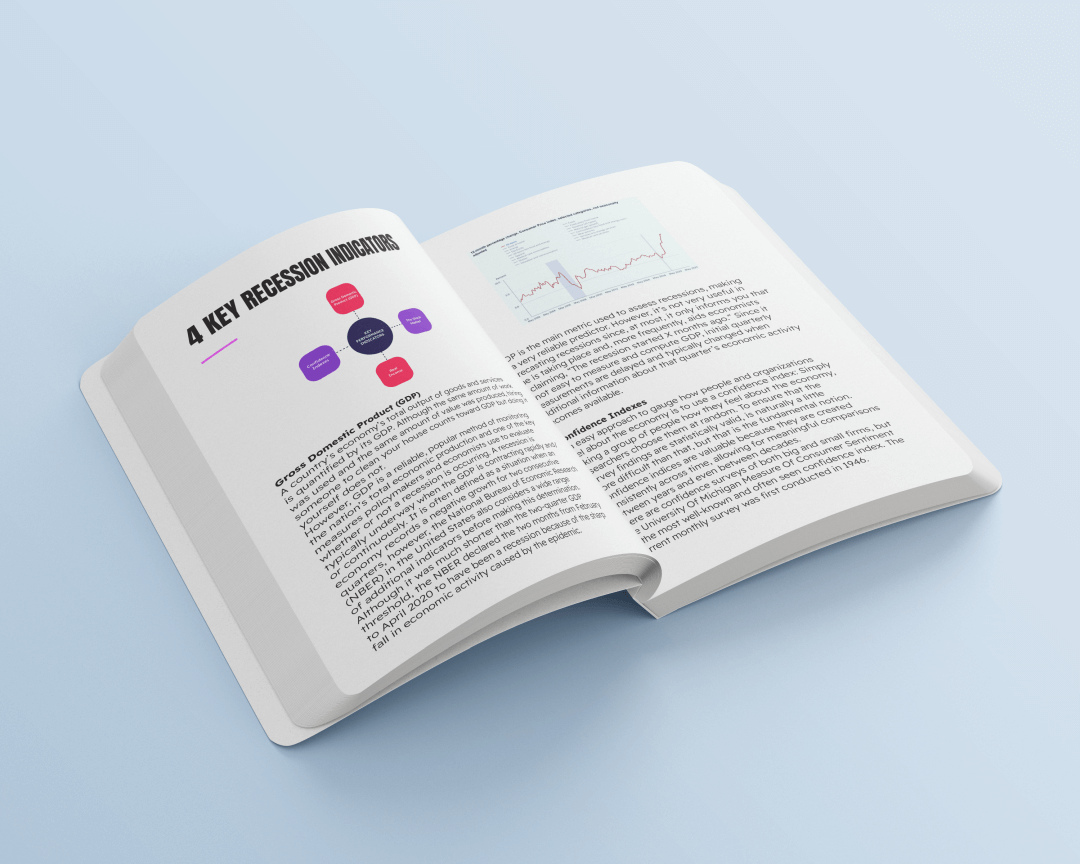

- 5 key recession indicators

- What is inflation?

- What drives inflation?

- Recession throughout history

- Subscription Revenue Model

- February 1945 through october 1945: the v-day recession

- Post-war brakes november 1948 – october 1949: tap recession

- July 1953 to may 1954: the m*a*s*h* recession

- August 1957 to april 1958: the investment bust recession

- “Rolling adjustment” from april 1960 to february 1961 had a recession

- December 1969 to november 1970: the guns and butter recession

- Part 1 of the iran and volcker recession: january to july 1980

- Double-dip: part 2 july 1981 through november 1982, a recession

- July 1990 until march 1991, the gulf war recession

- March 2001 to november 2001: the dot-bomb recession

- December 2007 to june 2009 marked the great recession

- February 2020 until april 2020: the covid-19recession

- The world’s most devastating financial crises explained

- The credit crisis of 1772

- The great depression of 1929–39

- The opec oil price shock of 1973

- The asian crisis of 1997

- The financial crisis of 2007–08

- Financial crisis 2008 vs financial crisis 2022

- Stagflation vs recession: which is worse

- Which one is worse between stagflation and inflation?

- Inflation vs stagflation: how do they differ?

- The covid-19 recession: february 2020–april 2020

- What is the shape of a recession?

- How bad the next recession could be?

- Why this global economic crisis is different?

- Is there a good inflation?

- Who is hurt most by inflation?

- Savers!!!

- Borrowers with adjustable-rate mortgages

- Who benefits from inflation?

- Business/household with high debt

- Governments with debt

- Owners of real estate and tangible assets

- Cpi inflation calculator explained

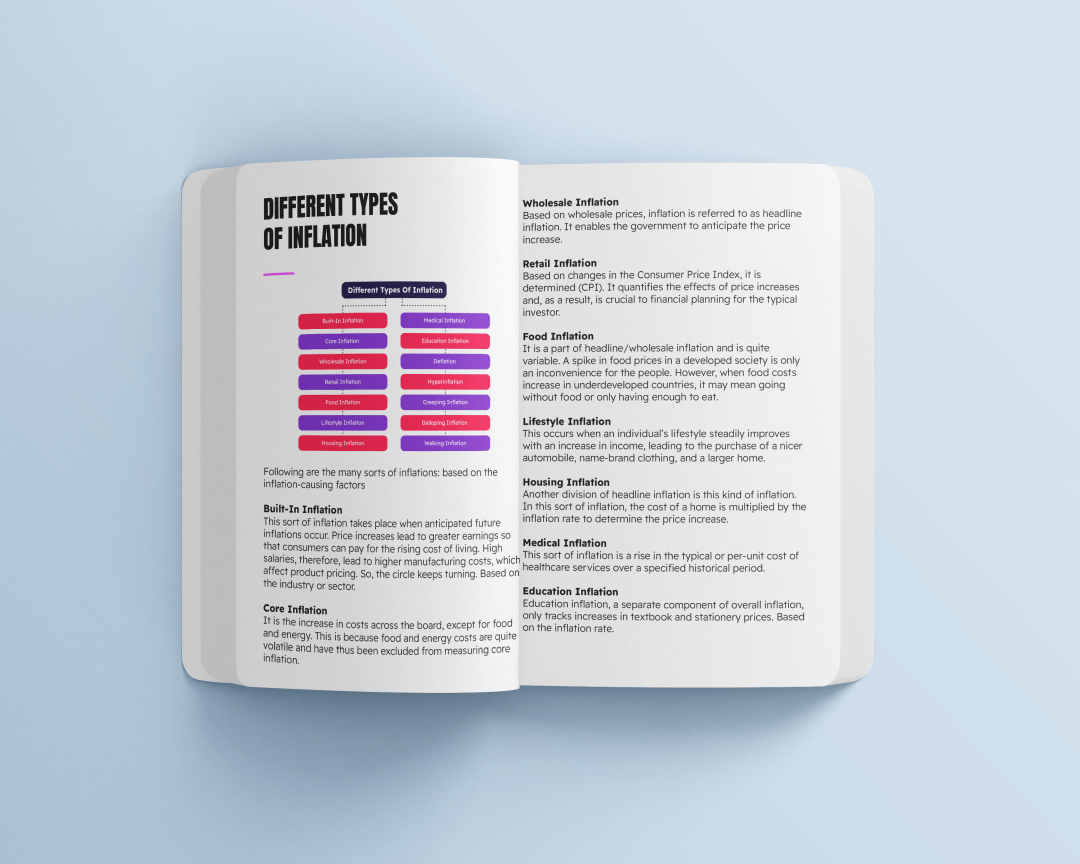

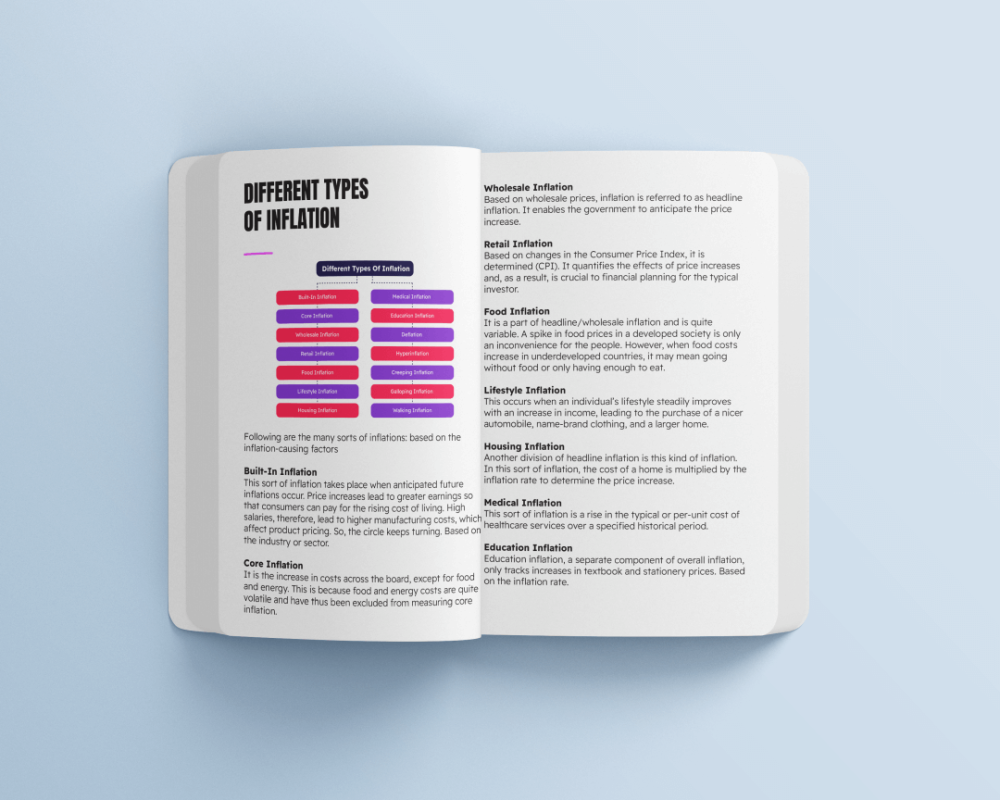

- Different types of inflation

- 3 key indicators show inflation is poised to ease

- 5 ways to prepare your finances for a recession?

- 6 mistakes to avoid during a recession

- Can you protect your 401k during a recession?

- Why does unemployment rise during a recession?

- The big risks of buying a house during a recession

- How long could the next recession last?

- How can a financial crisis be avoided?

- How will recession impact small businesses?

- How will recession impact s&p 500?

- How will recession impact crypto?

- How will recession impact stocks?

- Who can benefit from a recession?

- Should you diversify your assets?

- What is bucketing approach?

- How to use the retirement bucket Strategy

- The importance of a retirement budget

- The difference between a savings account and a cd (certificate of deposit)

- The importance of credit cards

- Personal credit benefits

- Business credit benefits

- Effects on the economy

- Rewards programs and other benefits

- What comes after recession?

- Conclusion

55 Products Included

All Products Special

Order our bestselling business bundle now and save a whopping $3,544 compared to buying each product separately.

Risk-free Purchase: Full refund within 14 days

Safe and Secure Checkout

This is a limited-time offer!

Testimonials

97%

Exeptional feedback from our readers

Risk-free Purchase: Full refund within 14 days

Risk-free Purchase: Full refund within 14 days

Safe and Secure Checkout

Safe and Secure Checkout